Table of Contents

Introduction to Adacash

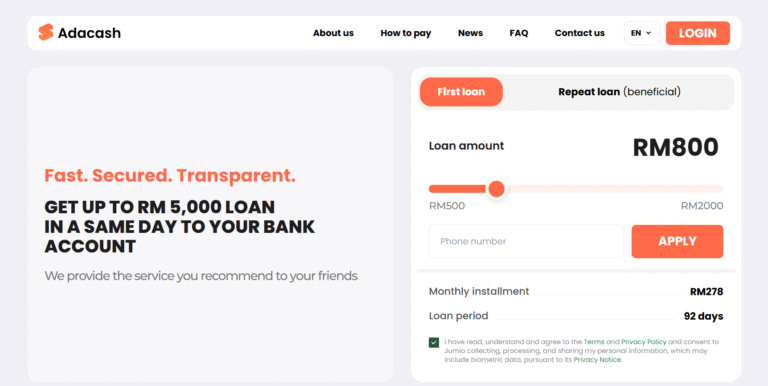

This article presents a detailed Adacash review and evaluates rising concerns regarding whether Adacash scam claims are legitimate. Adacash positions itself as a next-generation cryptocurrency designed for fast, low-fee transactions and decentralized payments. Its development team claims registration in an offshore jurisdiction, which immediately raises caution about legal accountability. With these factors in mind, the question remains: is Adacash a scam or a genuine crypto investment? This Adacash review uncovers all the warning signs potential investors need to know.

This review is specifically for two audiences: those who may have already been misled or lost money with Adacash and want clear, factual insights, and prospective investors who are suspicious and want to verify the platform before committing funds. We address your concerns directly and provide a careful evaluation of the coin’s risks and claims.

Adacash: Regulation & Legal Status

Currently, Adacash is not regulated by major authorities such as the SEC, FCA, or ASIC. While the project sometimes mentions compliance in marketing materials, these statements are not backed by official registration or verifiable licenses. This is common among many crypto projects targeting offshore markets.

Investing in unregulated projects carries risks: no client protection, no oversight, and no mechanisms to resolve disputes. Some projects have been known to suddenly disappear or block withdrawals, leaving investors exposed. For additional guidance on avoiding risky ventures, learn how to spot a scam broker before it’s too late. The lack of proper regulation raises serious questions about whether Adacash is a scam.

Trading Conditions & Platform Analysis of Adacash

Adacash operates primarily via decentralized exchanges (DEXs) and offers wallet-to-wallet transactions. Unlike regulated trading platforms, there are no account types, spreads, or traditional leverage. Its website promotes “instant, AI-assisted transactions,” yet provides minimal verification of liquidity sources or execution methods.

High-yield claims, promises of zero fees, or automated profits should be scrutinized. Even with a functional interface or blockchain explorer, the platform’s transparency and security are unverified. For careful evaluation, see what to check before signing up with a trading platform. These gaps make it harder to dismiss the possibility that Adacash might be a fraud.

Reputation & User Reviews About Adacash

Data on Adacash user engagement is scarce. Platforms such as CoinMarketCap or CoinGecko list minimal trading volume and limited liquidity pools. Social media feedback is mixed, with some users praising the concept but many warning about withdrawal delays or misleading promotional campaigns.

Be cautious of reviews on platforms like Trustpilot mentioning Adacash, as many are unverifiable or appear artificially generated. Low traffic and minimal active community engagement are further reasons for careful consideration.

How to Test Whether Adacash Is a Scam

Determining whether Adacash is a scam requires careful verification:

- Check regulation: Confirm licensing with authorities such as the SEC, FCA, or ASIC—none currently exist for Adacash.

- Red flags: Look for vague team identities, inflated claims, or unrealistic profits.

- Research user feedback: Investigate complaints on crypto forums and verified review sites.

- Platform quality: Poorly designed websites or unknown wallets may indicate higher risk. Use ScamDoc to assess website credibility.

- Withdrawal testing: Small test transfers can reveal potential restrictions or hidden fees.

Following these steps can help safeguard your investment and avoid common crypto scams.

Final Verdict & Alternatives

Adacash presents an intriguing concept of fast, AI-driven crypto transactions, but serious concerns remain regarding transparency, regulation, and security. The red flags outweigh the benefits, making it a high-risk project. Without verifiable licenses or proof of liquidity, prospective investors should proceed with extreme caution.

For safer alternatives, consider cryptocurrencies and platforms with strong regulatory oversight and verified trading infrastructure, such as Ethereum, Binance Smart Chain, or Polygon. Prioritize licensed, audited platforms to protect your funds.