Table of Contents

Introduction to Cindicator

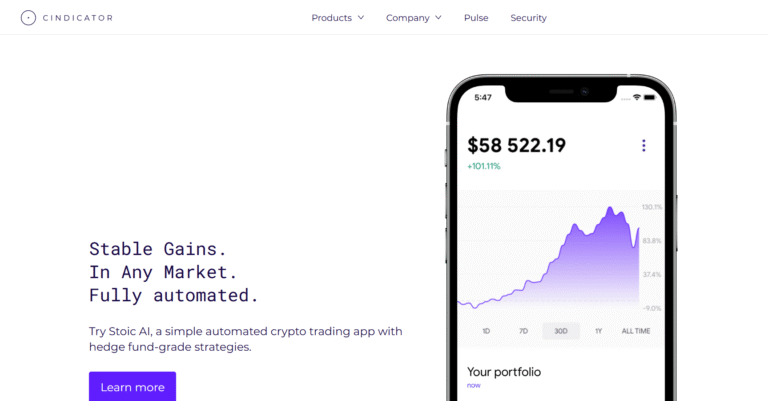

This article provides a thorough Cindicator review and investigates ongoing concerns about whether Cindicator scam claims are justified. Cindicator (CND) is a hybrid intelligence platform designed to provide predictive analytics for financial markets using both AI and crowd-sourced insights. Registered in the United States, the platform offers data-driven tools for traders and investors. However, users are rightfully asking: is Cindicator a fraud or a legitimate cryptocurrency project? This Cindicator review uncovers all the warning signs and critical details you need to know.

Our target audience includes those who may have experienced losses with Cindicator in the past and want to verify its legitimacy, as well as cautious investors considering investing and seeking reliable information.

Cindicator: Regulation & Legal Status

Cindicator is not classified as a security under major regulatory authorities like the SEC or FCA. While the company operates out of the United States, the token itself is largely unregulated. Some platforms might misleadingly reference top-tier authorities to appear credible, but this does not guarantee investor protection.

Operating in an unregulated environment means there is no oversight, no formal dispute resolution, and no guaranteed client protection. Similar risks have been seen in other crypto projects, making due diligence essential. Learn how to protect yourself and spot a scam before investing. This lack of regulatory clarity raises questions about whether Cindicator is a scam.

Trading Conditions & Platform Analysis of Cindicator

CND tokens are available for trading on multiple exchanges rather than traditional brokerage platforms. Account types, deposit minimums, and trading fees vary depending on the exchange. There is no leverage offered by Cindicator itself, but some exchanges may offer margin trading with limited transparency.

Investors should watch out for exaggerated profit claims and vague execution details. Just having access to token trading does not guarantee trust or safety. For thorough verification, visit what to check before signing up with a trading platform. These gaps make it difficult to ignore the possibility that some CND-related operations might be fraudulent.

Reputation & User Reviews About Cindicator

Cindicator has a mixed reputation across crypto review platforms. Sites like TrustPilot feature some verified reviews but also a noticeable number of unverifiable or overly positive testimonials. Users have reported issues with delayed payouts from exchanges and occasional platform glitches. Engagement metrics from SimilarWeb indicate moderate traffic, but this alone does not validate safety.

Patterns of fake reviews and unverified testimonials highlight the need for careful investigation before committing funds.

How to Test Whether Cindicator Is a Scam

To determine Cindicator’s legitimacy, investors should:

- Verify Regulation: Check if exchanges or wallets supporting CND are licensed.

- Look for Red Flags: Inconsistent whitepapers, vague claims, or aggressive marketing are warning signs.

- Read User Experiences: Investigate verified complaints and feedback on trusted crypto forums.

- Platform Testing: Avoid unknown platforms and test small amounts first. Use ScamDoc for Cindicator to check website credibility.

- Withdrawal Verification: Ensure clarity of staking or trading withdrawal processes.

These measures reduce risk but do not eliminate the need for careful consideration and ongoing monitoring of the CND ecosystem.

Final Verdict & Alternatives

While Cindicator itself is not a scam, investors should exercise caution due to the surrounding ecosystem’s regulatory gaps and potential for misleading platforms. Conduct due diligence before buying or trading CND tokens.

For safer options, consider regulated cryptocurrencies like Ethereum, Binance Coin, or Polygon. These alternatives benefit from regulatory oversight, audits, and community verification, making them more suitable for cautious investors.