Table of Contents

Introduction to Criptonopix

This Criptonopix review aims to provide a detailed analysis of the cryptocurrency project that has been circulating in online trading and investment circles. Criptonopix claims to be a next-generation digital asset designed to offer fast, secure transactions and blockchain-based services. However, numerous users have raised concerns about transparency, functionality, and overall credibility. This has prompted investors to question: is Criptonopix a scam or a legitimate project worth trusting? This Criptonopix review uncovers all the warning signs you need to know.

This review is especially for two types of readers: those who suspect they have been misled or scammed by Criptonopix, and those considering investing who want the facts before making a decision. If you fall into either group, the information below is for you.

Criptonopix: Regulation & Legal Status

One of the biggest concerns about Criptonopix is its regulatory status. Despite its claims of operating as a legitimate cryptocurrency project, there is no evidence that Criptonopix is licensed or overseen by reputable authorities like the FCA, ASIC, or SEC. Instead, Criptonopix appears to be registered in an offshore jurisdiction, which often provides no meaningful oversight or investor protections.

This lack of regulation poses serious risks to investors, including no dispute resolution mechanisms, no guaranteed protection of funds, and no accountability in case of misconduct. These are common red flags associated with questionable crypto projects. Learn how to spot a scam crypto project before it’s too late. The lack of oversight raises serious concerns about whether Criptonopix is a scam.

Trading Conditions & Platform Analysis of Criptonopix

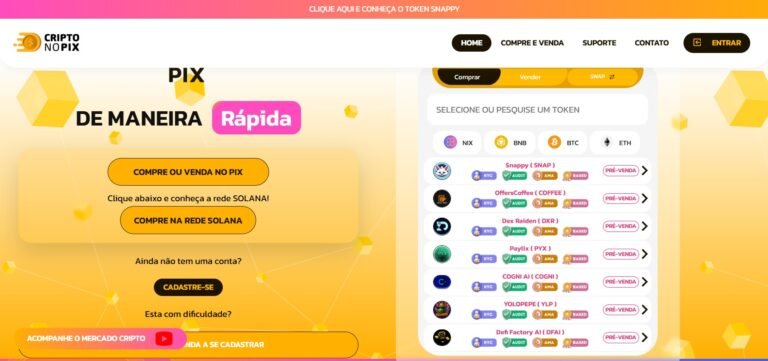

Criptonopix presents itself as a versatile cryptocurrency that supports trading and blockchain-based operations. However, upon closer inspection, there are significant gaps in information. There are no verifiable details about liquidity providers, technology partners, or actual blockchain performance metrics. The project also lacks transparency on its development team and roadmap progress.

Additionally, the project makes vague claims about high returns and “guaranteed” growth potential, which is highly unrealistic and a common tactic used to lure unsuspecting investors. Remember, simply having a blockchain or token does not guarantee credibility. Before engaging with such projects, know what to check before signing up with a crypto platform. These gaps make it harder to dismiss the idea that Criptonopix might be a fraud.

Reputation & User Reviews About Criptonopix

Feedback from users paints a concerning picture. On platforms like TrustPilot, there are multiple reports of delayed withdrawals, unresponsive support, and difficulty accessing invested funds. Many reviews also appear suspiciously generic, suggesting the presence of manipulated or fake testimonials to maintain a positive image.

Traffic analytics from web tools such as SimilarWeb indicate low engagement for Criptonopix’s platform, which contradicts its claims of a growing user base. Such discrepancies further fuel doubts about the project’s legitimacy and long-term viability.

How to Test Whether Criptonopix Is a Scam

If you’re unsure whether to trust Criptonopix, here are practical steps to assess its legitimacy:

- Verify licensing: Check if Criptonopix holds valid regulatory licenses with reputable authorities.

- Spot red flags: Be cautious of vague operational details or promises of guaranteed returns.

- Read credible reviews: Look for in-depth feedback from users on independent platforms.

- Check the platform: Poorly designed websites or malfunctioning apps are strong warning signs.

- Examine payment terms: Avoid projects that only allow crypto payments without refund policies.

- Beware of guarantees: No legitimate crypto project can promise risk-free profits.

If you suspect wrongdoing, consider reporting Criptonopix to the FTC or reviewing its trust score on ScamDoc.

Final Verdict & Alternatives

Based on its lack of regulation, operational opacity, and troubling user feedback, Criptonopix raises several red flags that cannot be ignored. While it presents itself as a promising cryptocurrency project, its inconsistencies and risks make it unsuitable for cautious investors.

Instead of taking unnecessary risks, consider exploring reputable and regulated cryptocurrencies with proven track records, such as Bitcoin, Ethereum, or projects operating under strict compliance frameworks. These alternatives provide far greater transparency and investor protection.

Always perform thorough due diligence before committing to any crypto investment. In a market full of opportunities and pitfalls, knowledge is your best defense.