Table of Contents

Introduction to Cube Exchange

This Cube Exchange review examines the legitimacy of the platform and its services. Cube Exchange presents itself as a modern cryptocurrency exchange offering secure trading for various digital assets, but questions remain about its operational transparency and regulatory standing.

Many potential users are asking is Cube Exchange a scam or a legitimate exchange? This article is aimed at two audiences: those who suspect Cube Exchange before investing and those who may have already experienced problems and want the truth. This Cube Exchange review uncovers all the warning signs you need to know.

Cube Exchange: Regulation & Legal Status

Regulation is crucial when assessing any exchange. Cube Exchange claims to be compliant with industry standards, but there is little evidence of regulation by top-tier financial authorities such as the FCA, ASIC, or CySEC. Instead, it appears to be operating in an offshore jurisdiction, which often raises concerns over investor protections.

The absence of strict oversight means no guaranteed dispute resolution, no client fund protection, and limited accountability if things go wrong. Similar tactics have been used by other unregulated exchanges to attract unsuspecting users.

Learn how to spot a scam broker before it’s too late. The lack of transparency raises serious concerns about whether Cube Exchange is a scam posing as a legitimate platform.

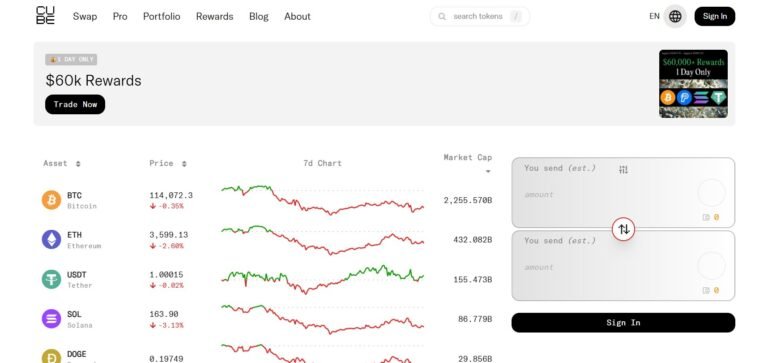

Trading Conditions & Platform Analysis of Cube Exchange

Cube Exchange offers cryptocurrency trading, but details about its platform, trading fees, and execution model are limited. Unlike well-regulated platforms that disclose full fee schedules and provide clear trading infrastructure, Cube Exchange leaves much of this information vague.

There’s no clear data about liquidity providers or whether it uses an STP/ECN model. Also, there are no guarantees of segregated client funds. While some platforms advertise advanced tools like MT4 or MT5, having access to these does not ensure credibility.

Before joining any platform, review what to check before signing up with a trading platform. These gaps in disclosure make it harder to dismiss the idea that Cube Exchange might be a fraud.

Reputation & User Reviews About Cube Exchange

User feedback about Cube Exchange is mixed. While some reviews praise its interface, multiple complaints across forums and sites like Trustpilot raise red flags. These include issues with withdrawals, unresponsive customer support, and sudden account freezes.

It’s also worth noting that some positive reviews may be fake or incentivized, a common tactic used to build artificial trust. Evaluating only verified and detailed feedback can provide a clearer picture of its true reputation.

How to Test Whether Cube Exchange Is a Scam

To determine if Cube Exchange is trustworthy, follow these steps:

- Verify regulation: Check for licenses on official sites like the SEC or other regulators.

- Watch for red flags: Missing license info or offshore-only registration is a concern.

- Check authentic user reviews: Search for complaints about withdrawals and support on credible forums.

- Inspect the platform: Poorly designed websites or limited trading features may signal risk.

- Review withdrawal policies: Vague or crypto-only withdrawal options are warning signs.

- Avoid unrealistic promises: Be cautious if the platform guarantees profits without risk.

If you suspect wrongdoing, report to authorities using tools like the FTC fraud reporting portal.

Final Verdict & Alternatives

While Cube Exchange offers cryptocurrency trading, the lack of regulatory oversight, vague trading conditions, and concerning user feedback make it a risky choice. Until it provides transparency and stronger compliance measures, it’s best to approach with caution.

For safer trading, consider regulated platforms with clear fee structures, robust customer support, and transparent operations. Protect your funds by choosing licensed exchanges with proven reputations.