Table of Contents

Introduction to Equalizer.Finance

This is a detailed Equalizer.Finance review created to address growing concerns about a possible Equalizer.Finance scam. Equalizer.Finance (EQZ) markets itself as a decentralized finance (DeFi) project focusing on flash loans and liquidity solutions, claiming to operate with transparency and innovation. While the platform says it is built on blockchain security and community governance, there is little clarity about its corporate registration or legal oversight.

The question remains: is Equalizer.Finance a scam or a legitimate cryptocurrency platform? This article is especially relevant to two groups — those who have already lost funds and seek clarity about what happened, and cautious investors who want facts before risking their capital. Anger, frustration, and skepticism are valid here. This Equalizer.Finance review uncovers all the warning signs you need to know.

Equalizer.Finance: Regulation & Legal Status

Equalizer.Finance does not appear to hold licensing from any major regulator such as the FCA, SEC, or ASIC. There are no public records showing that the project is registered in a jurisdiction with strong investor protections. References to blockchain compliance in promotional materials should not be mistaken for actual regulatory approval.

When dealing with unregulated crypto projects, investors face serious risks: no government oversight, no legal recourse, and no consumer protection if funds are lost. These same gaps have been exploited by fraudulent platforms in the past. For guidance, learn how to spot a scam broker before it’s too late. The lack of verified oversight raises legitimate concerns about whether Equalizer.Finance is a scam.

Trading Conditions & Platform Analysis of Equalizer.Finance

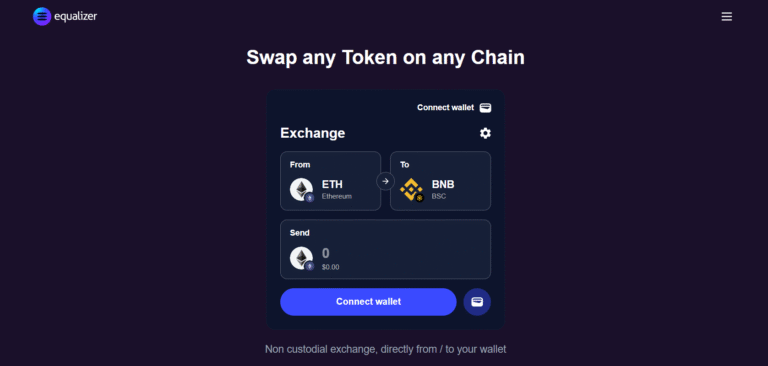

Equalizer.Finance offers services tied to flash loan execution and liquidity provisioning, but without traditional trading accounts, spreads, or leverage. While these DeFi tools are innovative in concept, the absence of transparency on smart contract audits, developer identities, and operational security is worrying.

Many investors may feel reassured by blockchain technology alone, yet this does not guarantee reliability. Without proof of secure liquidity pools or verified liquidity providers, trust is difficult to build. See what to check before signing up with a trading platform. These unanswered questions make it harder to dismiss the possibility that Equalizer.Finance might be a fraud.

Reputation & User Reviews About Equalizer.Finance

Feedback on Equalizer.Finance is mixed. Some users on DeFi forums praise the concept, while others claim withdrawal issues or a lack of responsiveness from the project team. Reviews on platforms such as Trustpilot for Equalizer.Finance are scarce and potentially unreliable, as fake testimonials are common in the crypto sector.

Traffic metrics from services like SimilarWeb suggest relatively low user engagement, which may indicate a niche audience rather than widespread adoption. For investors, this makes it harder to gauge the project’s long-term viability.

How to Test Whether Equalizer.Finance Is a Scam

Before committing funds, consider the following investigative steps:

- Verify licensing: Use official sites like SEC registration lookup to check for licenses.

- Look for red flags: Anonymous developers, vague roadmaps, and unverifiable audits are all warning signs.

- Research community sentiment: Cross-check user experiences on DeFi forums and review sites.

- Examine smart contract audits: Lack of third-party security audits increases risk.

- Review withdrawal terms: If crypto-only payments are allowed with no fiat off-ramp, proceed cautiously.

- Beware of unrealistic promises: Any claim of risk-free returns is suspicious.

- Test with small amounts: If you must try it, never start with a large investment.

These steps can help you decide if Equalizer.Finance is a scam or a legitimate project.

Final Verdict & Alternatives

Equalizer.Finance offers a unique DeFi concept, but significant gaps in regulation, transparency, and verifiable track record make it a high-risk choice. Without proper licensing and proven security, the dangers outweigh the benefits for most investors.

Safer alternatives include regulated exchanges and DeFi platforms with audited smart contracts, such as Aave, Compound, or Uniswap. Always conduct independent research and choose licensed platforms to safeguard your funds.