Table of Contents

Introduction to Evil Pepe

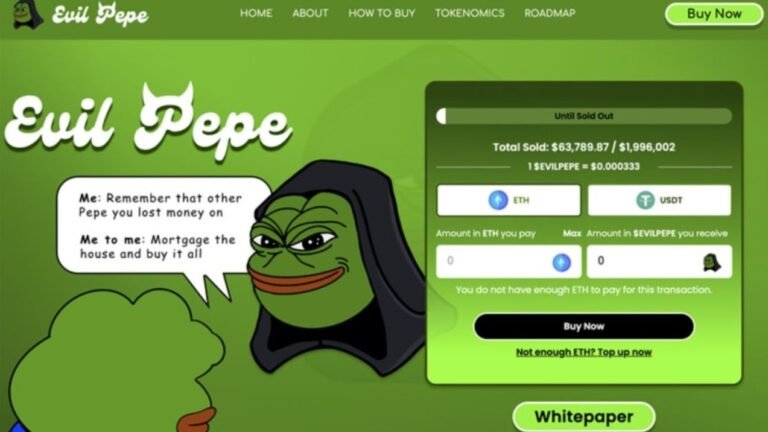

This article provides a detailed Evil Pepe review, designed for individuals who want to understand whether Evil Pepe is a legitimate cryptocurrency or just another deceptive project. Evil Pepe is presented as a meme-based crypto token, leveraging community-driven hype and promising significant growth potential. It claims to offer strong community backing and tokenomics intended to reward holders.

But crucial questions remain unanswered — is Evil Pepe a scam or a genuine project worth investing in? For readers who suspect they may have already been scammed or those cautiously evaluating Evil Pepe before investing, this review dives deep into its offerings, transparency, and risks. This Evil Pepe review uncovers all the warning signs you need to know.

Evil Pepe: Regulation & Legal Status

Evil Pepe operates in the decentralized cryptocurrency market and is not regulated by any financial authority like the FCA, ASIC, or CySEC. The token is primarily driven by its community and project developers, with no formal oversight or legal registration in a recognized jurisdiction.

This lack of regulation is a major concern because unregulated tokens provide no investor protection, no legal recourse in the event of disputes, and often engage in misleading marketing to attract investors. Similar tactics have been seen in other meme coins that quickly disappeared after attracting funds.

Before engaging with this project, take time to learn how to spot a scam broker before it’s too late. The absence of regulation raises serious questions about whether Evil Pepe is a scam or simply an unprotected, high-risk investment.

Trading Conditions & Platform Analysis of Evil Pepe

Unlike traditional trading platforms, Evil Pepe is primarily available on decentralized exchanges (DEXs), meaning it lacks standard account types, leverage, or trading spreads. Its accessibility depends on using compatible wallets and interacting with automated market makers (AMMs).

There are no clear details about liquidity provider transparency or whether any protections exist for buyers. This leaves investors vulnerable to price manipulation, low liquidity risks, and potential “rug pulls” — a common tactic in meme coin scams.

Just because a token is listed on a decentralized platform doesn’t mean it is safe. Always check what to verify before signing up with a trading platform. These uncertainties make it harder to dismiss the possibility that Evil Pepe might be a fraud.

Reputation & User Reviews About Evil Pepe

Reviews of Evil Pepe on platforms like TrustPilot are limited and often polarized. Some users praise its community-driven approach, while others complain about losing money due to sudden price drops and difficulty in selling their tokens.

Independent validators and review aggregators, such as ScamDoc, score Evil Pepe poorly on trustworthiness, citing a lack of transparency and verifiable project details. These patterns align with high-risk tokens that thrive on speculation rather than tangible value.

Traffic and engagement metrics also suggest Evil Pepe has a fluctuating user base, which is typical for meme coins reliant on short-term hype rather than long-term utility.

How to Test Whether Evil Pepe Is a Scam

To evaluate if Evil Pepe is a scam, follow these steps:

- Check regulation: Verify whether the token or its developers are registered with any recognized financial authority. In this case, Evil Pepe is unregulated.

- Look for red flags: Vague promises, anonymous developers, and no clear whitepaper are immediate warning signs.

- Read real reviews: Check user experiences on forums, social media, and independent sites like TrustPilot to gauge real sentiment.

- Test the platform: Use small amounts to test transactions and assess if the token can be bought and sold without issues.

- Review withdrawal terms: If your funds are locked or withdrawals are restricted, it’s a major red flag.

- Beware false promises: Guaranteed profits or unrealistic returns are classic signs of fraud.

- Experiment cautiously: Since there’s no demo account, only engage with funds you can afford to lose.

Final Verdict & Alternatives

Evil Pepe appears to be a speculative meme coin with little to no regulation, minimal transparency, and substantial risks. While some investors might profit from early trading, the lack of oversight, verifiable information, and strong project fundamentals makes it an unsafe choice for most.

For those seeking safer investments, consider regulated platforms and well-established cryptocurrencies with proven track records. Always ensure you are trading on platforms that comply with industry standards and offer proper investor protection.

For reporting suspected fraud, visit the FTC’s fraud reporting platform or check token credibility using tools like EvenInsight’s safety checker.