Table of Contents

Introduction to Ramp (RAMP)

This article provides a detailed Ramp review, highlighting the key concerns that investors should consider regarding Ramp scam allegations. Ramp is a decentralized finance (DeFi) token designed to facilitate cross-chain staking and liquidity operations. The project claims to operate globally, with its development team reportedly based in several offshore jurisdictions. With promises of high yields and innovative staking features, many wonder: is Ramp a scam or a legitimate cryptocurrency project? This Ramp review uncovers all the warning signs you need to know.

Our primary audience includes those who feel they may have been misled by Ramp and want verified information, as well as cautious potential investors seeking trustworthy insights before engaging with the token. We acknowledge the frustration and skepticism surrounding unregulated crypto ventures.

Ramp (RAMP): Regulation & Legal Status

Ramp operates as a decentralized token without direct oversight from traditional regulatory bodies such as the SEC, FCA, or ASIC. While decentralized projects often avoid formal regulation, the lack of official scrutiny means there is no formal protection or dispute resolution for token holders.

Some Ramp marketing materials may misleadingly reference partnerships with established entities, creating an illusion of legitimacy. Similar strategies have been seen in other DeFi scams. For guidance, learn how to spot a scam broker before it’s too late. The lack of oversight raises serious questions about whether Ramp is a scam.

Trading Conditions & Platform Analysis of Ramp

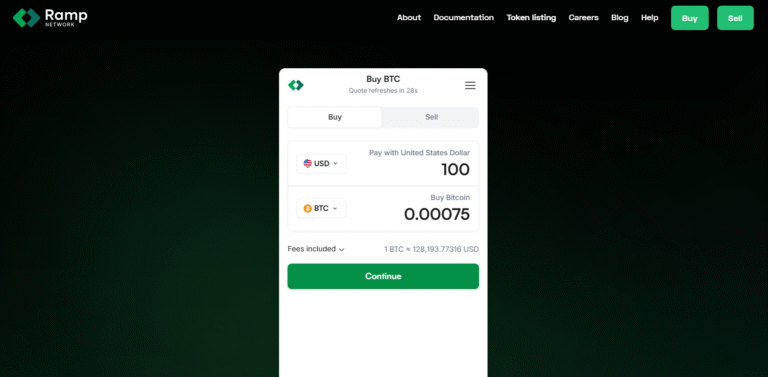

Ramp is primarily accessed through decentralized exchanges (DEXs) and staking platforms. There are no traditional account types, MT4/MT5 platforms, or standardized trading conditions. Users typically interact via Web3 wallets like MetaMask, connecting to liquidity pools to earn rewards.

While the potential for high yields exists, Ramp’s documentation lacks detailed information on liquidity providers, slippage control, or smart contract audits. For safety, review what to check before signing up with a trading platform. These gaps make it harder to dismiss the idea that Ramp might be a fraud.

Reputation & User Reviews About Ramp

Ramp has a mixed reputation in the DeFi community. Some users praise its innovative staking mechanisms, but others report slow transaction confirmations, wallet compatibility issues, and difficulties in withdrawing earned tokens. Traffic analysis shows moderate DEX activity, yet the overall user engagement remains limited.

Platforms like Ramp on TrustPilot show many positive reviews that are difficult to verify, suggesting possible manipulation. Community feedback on Reddit and Telegram groups points to occasional outages and unclear communication from the development team.

How to Test Whether Ramp Is a Scam

To determine if Ramp is a scam:

- Check Regulation: Verify if any associated exchanges or platforms hold licenses via authorities like SEC or FCA.

- Spot Red Flags: Vague smart contract audits, unverifiable team claims, and exaggerated yield promises are warning signs.

- Read Real User Reviews: Scrutinize complaints on forums and social media for consistent issues.

- Test Platforms Carefully: Assess platform design, security measures, and wallet integration.

- Review Withdrawal Terms: Ensure you understand token release schedules and staking lockups.

- Use Small Investments First: Limit exposure until you confirm reliability and transparency.

Final Verdict & Alternatives

Ramp represents an innovative DeFi concept but carries significant risks. Unregulated operations, limited transparency, and occasional user complaints suggest caution. Investors should be wary of committing large sums without thorough research.

Safer alternatives include regulated DeFi projects on Ethereum and Binance Smart Chain that maintain transparent audits and verifiable teams. Prioritizing licensed and trustworthy platforms helps protect your investments and avoid potential losses.