Table of Contents

Introduction to Safuu

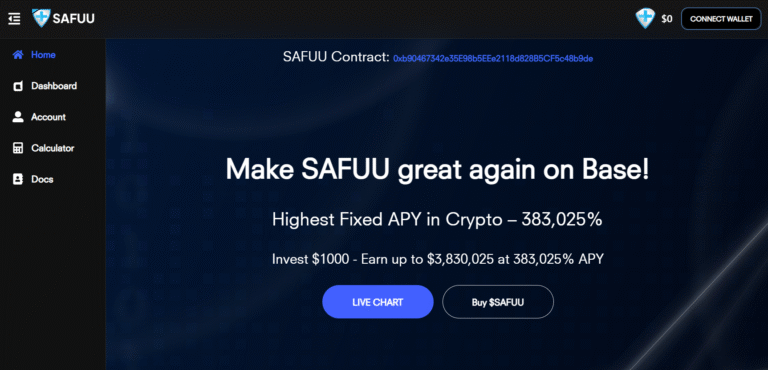

This in-depth Safuu review examines whether the project’s claims of extremely high annual percentage yields are realistic or a classic case of a Safuu scam. Safuu presents itself as an auto-staking and auto-compounding protocol promising investors an annual yield of over 380,000%, which raises immediate questions about its sustainability. While the token originated with a flashy launch and gained quick attention in the DeFi space, many investors are now asking: is Safuu a scam or a legitimate cryptocurrency project? This Safuu review will uncover the facts, red flags, and investor concerns you should know.

We have written this for two primary audiences: those who already suspect they’ve been scammed by Safuu and are seeking clear, factual information, and those considering investing in Safuu but want to verify its legitimacy before risking their money. If you’re feeling frustrated or misled, this article will help you navigate the truth.

Safuu: Regulation & Legal Status

Safuu operates entirely outside of regulated financial systems. There is no evidence of licensing from recognized authorities like the U.S. Securities and Exchange Commission (SEC), FCA, ASIC, or CySEC. Instead, Safuu’s operations appear to be self-governed, with no jurisdiction providing investor protections or oversight.

This lack of regulation is a critical red flag. In some cases, crypto projects falsely imply association with reputable regulators to build trust. Similar tactics have been seen in other collapsed DeFi schemes, where investors had no recourse when funds disappeared. Without oversight, there is no guarantee of fair treatment, secure transactions, or even accurate reporting of token supply.

If you’re unfamiliar with how to identify such risks, learn how to spot a scam broker before it’s too late. The absence of formal licensing leaves investors asking the hard question: is Safuu a scam?

Trading Conditions & Platform Analysis of Safuu

Safuu’s model is built around DeFi staking through smart contracts, meaning there are no standard account types, leverage options, or regulated spreads. The entry barrier is minimal—users can buy tokens directly on decentralized exchanges—but the advertised compounding rates are far beyond what’s sustainable in legitimate finance.

Another concern is the complete lack of transparency regarding liquidity providers or proof of reserves. Safuu also does not undergo independent audits from recognized blockchain security firms, leaving investors vulnerable to smart contract exploits or outright rug pulls.

It’s important to remember that even if a token uses sophisticated DeFi platforms, this does not guarantee trustworthiness. Review token fundamentals with tools like what to check before signing up with a trading platform. These gaps make it harder to dismiss the idea that Safuu might be a fraud.

Reputation & User Reviews About Safuu

Feedback about Safuu is polarizing. Early adopters praise the high yields—often without mentioning the inherent risks—while others report heavy losses after price collapses. Reports on Safuu reviews on TrustPilot show a mix of glowing testimonials and severe complaints, including sudden withdrawal restrictions and disappearing community support.

Several independent crypto watchdogs have flagged Safuu’s tokenomics as unsustainable, warning that such high promised returns typically rely on a constant influx of new buyers—a hallmark of Ponzi-style structures.

How to Test Whether Safuu Is a Scam

If you are unsure about Safuu’s legitimacy, you can follow these steps:

- Verify Regulation: Check for official licensing; Safuu is currently unregulated.

- Identify Red Flags: Be wary of vague roadmaps, anonymous teams, or unrealistic returns.

- Read Independent Reviews: Use sources like TrustPilot, Reddit, or blockchain audit reports.

- Check Smart Contract Audits: If none exist from reputable firms, this is a major warning sign.

- Test the Platform: Use minimal investment first; avoid going all-in on unverified projects.

- Review Withdrawal Policies: Lack of clear and accessible withdrawal terms is suspicious.

- Look for False Guarantees: Claims of “risk-free” investing in crypto are almost always deceptive.

Using a combination of these checks—along with tools like the Safuu smart contract validator—will help you decide if the project is safe or a potential fraud.

Final Verdict & Alternatives

While Safuu markets itself as a groundbreaking auto-staking protocol, its lack of regulation, unrealistic APY promises, and absence of transparency put it firmly in the high-risk category. Investors should approach with extreme caution, if at all.

If you want to earn passive income through crypto without such high risks, consider regulated exchanges and staking services offered by platforms like Binance, Coinbase, or Kraken. These companies are licensed, transparent, and provide investor protections.

In the unpredictable world of DeFi, the safest move is to trade only on verified, regulated platforms and avoid projects with promises that sound too good to be true.

Safuu Scam Review: Is This High-APY Crypto a Legit Investment or Fraud?