Table of Contents

Introduction to SingularityDAO

This article provides a comprehensive SingularityDAO review and investigates ongoing concerns about potential SingularityDAO scam claims. SingularityDAO (SDAO) is a decentralized finance platform that combines AI-driven asset management with blockchain technology, offering dynamic crypto portfolios called DynaSets. The project is registered in Singapore and aims to enhance portfolio management for investors. However, users are asking: is SingularityDAO a scam or a legitimate cryptocurrency project? This SingularityDAO review uncovers all the key warning signs and essential details you need to know.

Our audience includes individuals who may have experienced losses with SDAO and want to verify its legitimacy, as well as cautious investors considering participation and seeking factual information before investing.

SingularityDAO: Regulation & Legal Status

SingularityDAO is not directly regulated by major financial authorities such as the SEC, FCA, or ASIC. While the company operates out of Singapore, the token itself remains unregulated in most jurisdictions. Some marketing materials may misleadingly imply compliance with top-tier authorities, but these references do not guarantee protection for investors.

Investing in an unregulated crypto asset carries risks including no formal oversight, no dispute resolution, and no client protection. Similar risks have been seen in other DeFi projects. Learn how to protect yourself and spot a scam before investing. This regulatory gap raises concerns about whether SingularityDAO is a scam.

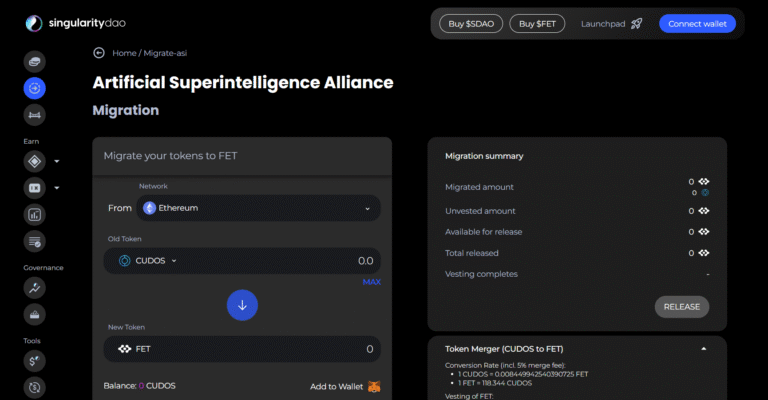

Trading Conditions & Platform Analysis of SingularityDAO

SDAO tokens are primarily traded on crypto exchanges rather than traditional brokerage platforms. Account requirements, minimum deposits, and trading fees differ per exchange. SingularityDAO offers AI-managed DynaSets but does not provide leverage or traditional spreads. Some exchanges might offer margin trading with limited transparency.

Investors should be cautious of exaggerated promises, opaque execution details, or unverifiable liquidity sources. Simply having access to AI-managed portfolios does not confirm legitimacy. Check what to verify before investing at what to check before signing up with a trading platform. These gaps make it harder to dismiss the possibility that parts of the SDAO ecosystem might be fraudulent.

Reputation & User Reviews About SingularityDAO

SingularityDAO has mixed reviews across crypto evaluation platforms. Sites like TrustPilot include a mix of verified and suspicious reviews. Some users report delayed transactions or confusion with DynaSet management. According to SimilarWeb, the website shows moderate engagement, but traffic alone cannot guarantee trustworthiness.

Patterns of unverifiable testimonials and overly positive reviews highlight the need for investor vigilance.

How to Test Whether SingularityDAO Is a Scam

To assess the legitimacy of SingularityDAO, consider the following steps:

- Verify Regulation: Confirm licensing status of exchanges and wallets handling SDAO.

- Look for Red Flags: Vague whitepapers, unrealistic returns, or aggressive marketing may indicate risk.

- Read Real Reviews: Check verified complaints and feedback on crypto forums or Reddit.

- Test Platforms: Avoid unknown exchanges and consider starting with small amounts. You can also use ScamDoc for SingularityDAO to analyze platform safety.

- Withdrawal Transparency: Ensure clear processes for token withdrawals and portfolio exits.

These steps reduce risk but cannot guarantee complete security, emphasizing the need for cautious investment decisions.

Final Verdict & Alternatives

While SingularityDAO is not inherently a scam, investors should proceed carefully due to limited regulatory oversight and potential platform risks. Conduct thorough research before investing in SDAO tokens.

For safer alternatives, consider regulated and well-established crypto projects such as Ethereum, Binance Coin, or Cardano. These options benefit from oversight, audits, and community verification, providing a more secure environment for cautious investors.