Table of Contents

Introduction to SpectroCoin

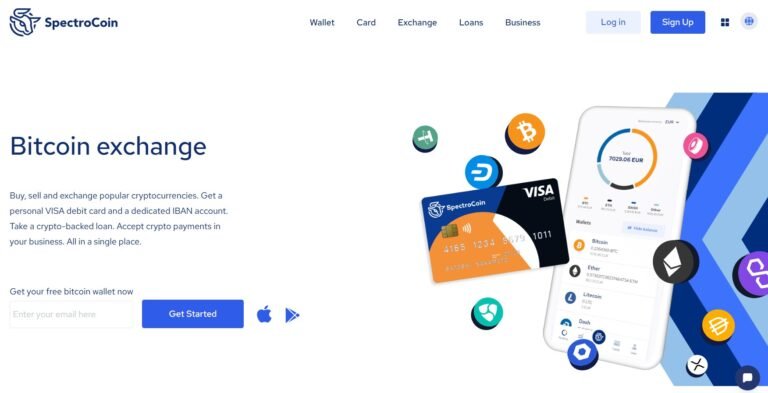

This article offers a detailed SpectroCoin review focused on helping users determine whether SpectroCoin is a legitimate cryptocurrency platform or a potential scam. SpectroCoin claims to provide a wide range of crypto services including a wallet, exchange, payment solutions, and debit cards. The platform is registered in Lithuania and positions itself as a comprehensive crypto ecosystem.

Despite these claims, there is ongoing debate about the platform’s trustworthiness. Is SpectroCoin a scam or a reliable service? This SpectroCoin review aims to highlight all critical factors so you can make an informed decision.

If you have been scammed or feel suspicious before investing, this review addresses your concerns and frustration by revealing the facts about SpectroCoin’s legitimacy and risks involved.

SpectroCoin: Regulation & Legal Status

SpectroCoin is registered and operates under Lithuanian jurisdiction, complying with European Union regulations on financial services. It holds a license as a virtual currency exchange and wallet provider under Lithuanian law.

However, it is important to note that the platform is not regulated by top-tier authorities such as the FCA (UK) or ASIC (Australia). This can be concerning for users seeking stronger investor protections.

Unregulated platforms carry risks including lack of oversight, limited dispute resolution mechanisms, and no formal client protection schemes. Users should stay vigilant, especially when platforms make vague or misleading claims about regulatory endorsements.

For more insights on how to evaluate crypto platforms, you can learn how to spot a scam broker before it’s too late. The level of regulatory oversight raises important questions about whether SpectroCoin is a scam.

Trading Conditions & Platform Analysis of SpectroCoin

SpectroCoin offers several account types and services such as crypto trading, fiat deposits, and debit card integration. However, detailed information on trading fees, spreads, or leverage is limited on their website.

The platform provides a proprietary exchange interface rather than popular third-party trading platforms like MT4 or MT5, which might concern traders looking for transparent trade execution.

Promises of fast withdrawals and seamless crypto-fiat conversions are appealing, but the absence of clear data on liquidity providers and order execution adds uncertainty.

Before engaging, consider what to check before signing up with a trading platform to protect your investments. Such gaps contribute to doubts that SpectroCoin might be a fraud.

Reputation & User Reviews About SpectroCoin

User reviews on platforms like Trustpilot show a mix of positive and negative feedback. Common complaints include withdrawal delays, customer support responsiveness, and occasional technical glitches.

While some testimonials appear genuine, a noticeable portion of reviews are generic or overly positive, raising concerns about review authenticity.

Web traffic analysis shows consistent user engagement, but that alone does not guarantee trustworthiness. It is essential to critically evaluate all available information when deciding whether to trust a platform.

How to Test Whether SpectroCoin Is a Scam

To assess SpectroCoin’s legitimacy, follow these steps:

- Verify regulation: Confirm licensing status on official sites like the SEC or local regulators.

- Watch for red flags: Be cautious of unclear legal disclosures or inconsistent licensing information.

- Review user feedback: Check complaints on independent forums and watchdog sites.

- Test platform quality: Evaluate website design, ease of use, and customer support.

- Analyze withdrawal policies: Look for clear terms and reasonable processing times.

- Beware of unrealistic claims: No legitimate platform guarantees profits without risk.

- Try demo or small transactions: Test services cautiously before larger investments.

For additional safety checks, the FTC fraud reporting portal is a useful resource to report suspicious platforms or review past complaints.

Final Verdict & Alternatives

SpectroCoin presents a mixed picture: it is registered and compliant with Lithuanian law but lacks broader regulation from top-tier authorities. Combined with mixed user feedback and limited transparency, caution is warranted.

If you detect more red flags than advantages, it is prudent to avoid or minimize your exposure. Instead, consider reputable, fully regulated alternatives such as Coinbase, Kraken, or Binance, which provide higher security and customer protection.

Remember, trading only on licensed and well-regulated platforms is the safest way to protect your crypto investments.