Table of Contents

Introduction to Wirex

This is a detailed Wirex review written for crypto users who are either already suspicious of the coin or, worse, have been scammed by related platforms. Wirex presents itself as a utility token designed to power a borderless payment ecosystem. The project claims to support fiat-to-crypto spending, reward-based staking, and seamless wallet integration. The coin is tied to the broader Wirex app, reportedly headquartered in the UK, although its token operations seem less transparent.

As reports of suspicious behavior and inaccessible funds grow, many users are left asking: is Wirex a scam or a trustworthy project? This Wirex review uncovers all the warning signs you need to know.

Wirex: Regulation & Legal Status

While the Wirex app is reportedly regulated by the UK’s Financial Conduct Authority (FCA) for e-money services, its native token (WXT) appears to operate in a regulatory gray area. There’s no clear statement on whether the token itself is regulated or overseen by financial authorities.

Many users assume the token is protected simply because the company holds an FCA registration—but this doesn’t necessarily apply to the cryptocurrency itself. This kind of regulatory bait-and-switch is common among hybrid fintech/crypto projects that mix regulated financial services with unregulated digital assets.

Users should be cautious and verify Wirex’s regulatory standing before assuming it’s safe. The lack of direct oversight over the coin raises legitimate concerns about whether Wirex is a scam masked by its parent platform’s reputation.

Trading Conditions & Platform Analysis of Wirex

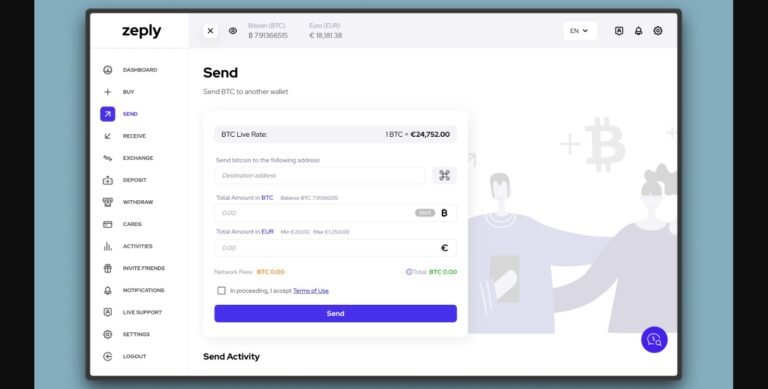

Wirex promotes the WXT token as a multi-purpose utility coin used for transaction fee savings, staking rewards, and cashback incentives within its ecosystem. However, there is minimal transparency about token liquidity, how it’s issued, or what mechanisms are in place to protect its value.

There is no evidence of Wirex partnering with regulated liquidity providers or offering third-party verification of trading metrics. While users can buy or swap WXT via the Wirex app, details on spreads, commissions, or execution quality are vague.

It’s also worth noting that flashy interfaces or integrations with third-party wallets do not guarantee security. Before engaging, read what to check before signing up with a trading platform to avoid hidden risks.

These issues, combined with unclear tokenomics, make it difficult to dismiss the growing concerns that Wirex might be a fraud.

Reputation & User Reviews About Wirex

Wirex has a very mixed online reputation. On platforms like Trustpilot, users report both positive and deeply concerning experiences. While some praise the convenience of the Wirex app, others accuse the platform of freezing funds, offering poor customer support, and arbitrarily locking accounts.

Several users claim they were lured by crypto bonuses or cashback incentives, only to find withdrawals blocked or accounts suddenly inaccessible. These issues are frequently echoed in independent crypto forums and complaint boards.

According to ScamDoc’s report on Wirex, the trust rating of the site is lower than expected for a supposedly established brand. Combined with low transparency around WXT token use, the user feedback should raise red flags.

These patterns in reviews further fuel the question: is Wirex a scam hidden behind a shiny interface and half-regulation?

How to Test Whether Wirex Is a Scam

Determining the legitimacy of a crypto project like Wirex involves several key steps. If you’re already feeling uneasy or burned, follow this checklist to help confirm your suspicions:

- Verify licenses and regulation: Confirm whether the entity behind the token, not just the app, is listed on official sites like the SEC or FCA registers.

- Investigate the tokenomics: Projects with unclear supply, use cases, or manipulation-prone incentives are risky.

- Review real user complaints: Look beyond ratings and dig into actual experiences on Reddit, TrustPilot, or crypto forums.

- Test the platform functionality: If your account gets frozen or delays happen with no recourse, that’s a major red flag.

- Analyze withdrawal options: If the platform pushes only crypto withdrawals or charges hidden fees, be cautious.

- Avoid promises of guaranteed returns: These are almost always signs of manipulation or deceptive marketing.

You can also use platforms like the FTC’s fraud portal to report suspicious activity or look for official warnings related to Wirex.

Final Verdict & Alternatives

While the Wirex brand might appear trustworthy at first glance due to its FCA registration, its WXT token and broader crypto operations remain opaque and potentially high-risk. The combination of user complaints, regulatory ambiguity, and vague platform practices should not be ignored.

If you’re looking for safer alternatives, consider investing in regulated cryptocurrencies available on reputable exchanges like:

- Coinbase – Fully licensed and offers strong consumer protections.

- Kraken – Known for transparency and compliance with U.S. regulations.

- Gemini – Regulated by the New York State Department of Financial Services.

Ultimately, the question “is Wirex a fraud?” can’t be answered definitively, but the mounting red flags suggest caution is more than warranted. Don’t risk your capital on unverified promises—choose security and transparency instead.