Table of Contents

Introduction to XRP20

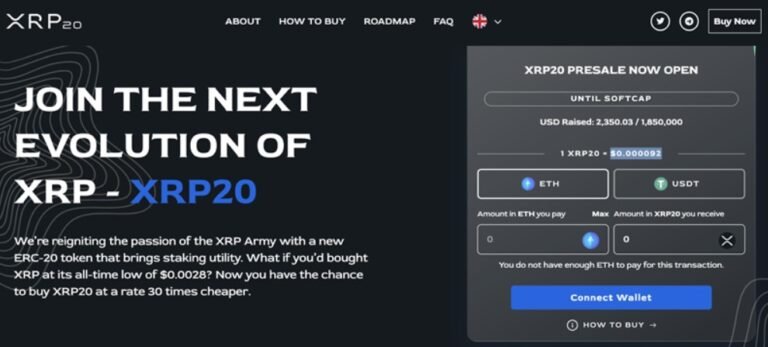

This comprehensive XRP20 review aims to uncover the truth behind this crypto project. XRP20 markets itself as a reimagined version of Ripple (XRP), built on the Ethereum blockchain with enhanced staking and burning mechanisms. It has attracted significant attention from investors worldwide.

However, growing concerns from users asking is XRP20 a scam warrant deeper investigation. Our primary audience includes those who suspect XRP20 may be misleading and those who may already have suffered losses. This XRP20 review uncovers all the warning signs you need to know before investing.

XRP20: Regulation & Legal Status

Upon review, XRP20 does not appear to be regulated by any major financial authority such as the U.S. SEC, FCA, or ASIC. Instead, it operates as a decentralized project with no clear corporate entity behind it. This lack of corporate structure raises red flags for investors seeking accountability.

Many crypto projects like XRP20 often imply compliance or reference partnerships with reputable entities without providing verifiable proof. Such tactics mislead investors into a false sense of security. Without regulatory oversight, there are no safeguards for your funds, no client protection, and no reliable dispute resolution process.

Learn how to spot a scam broker before it’s too late. The lack of transparency and oversight raises serious concerns about whether XRP20 is a scam.

Trading Conditions & Platform Analysis of XRP20

XRP20 offers its token on decentralized exchanges, but critical details about its liquidity, tokenomics distribution, and developer transparency remain limited. While it promises token burns and staking rewards, there is no third-party verification of these processes.

Investors should be cautious of projects that promote high returns without substantiating how those returns are generated. Furthermore, XRP20 lacks public information on liquidity providers, team credentials, or long-term sustainability plans.

Before committing funds, review what to check before signing up with a trading platform. These missing details make it increasingly difficult to dismiss the suspicion that XRP20 might be a fraud.

Reputation & User Reviews About XRP20

Public feedback about XRP20 varies significantly. While some users praise its potential as a low-cost entry to the Ripple ecosystem, others report issues with token utility and accessibility. The lack of credible partnerships or independent audits further adds to the skepticism.

On platforms like TrustPilot, XRP20 reviews appear limited and possibly manipulated. SimilarWeb analytics suggest that traffic to XRP20’s official site is inconsistent, signaling a lack of strong community engagement and transparency.

How to Test Whether XRP20 Is a Scam

If you are questioning is XRP20 a scam, here are practical steps to verify:

- Check regulatory status: Confirm whether XRP20 has any recognized licenses with bodies like the SEC, FCA, or CySEC.

- Investigate the team: Look for transparent disclosures about developers and project leaders.

- Review independent audits: Legitimate tokens often undergo third-party code reviews.

- Examine user complaints: Research issues on forums and review aggregators like Forex Peace Army and TrustPilot.

- Analyze withdrawal options: Be wary if the project only supports crypto transactions without flexible withdrawal solutions.

- Test project claims: Avoid tokens promising guaranteed profits or unrealistic returns.

If you suspect wrongdoing, report it through the FTC fraud reporting portal to help prevent further scams.

Final Verdict & Alternatives

XRP20 positions itself as an innovative alternative to Ripple, but its lack of regulation, transparency, and verifiable backing make it a high-risk project for investors. For cautious traders, these red flags outweigh any potential benefits.

Consider safer alternatives by engaging only with projects that are regulated, audited, and backed by credible teams. Responsible investing begins with thorough research and selecting platforms with proven trust records.