Table of Contents

Introduction to XRP20

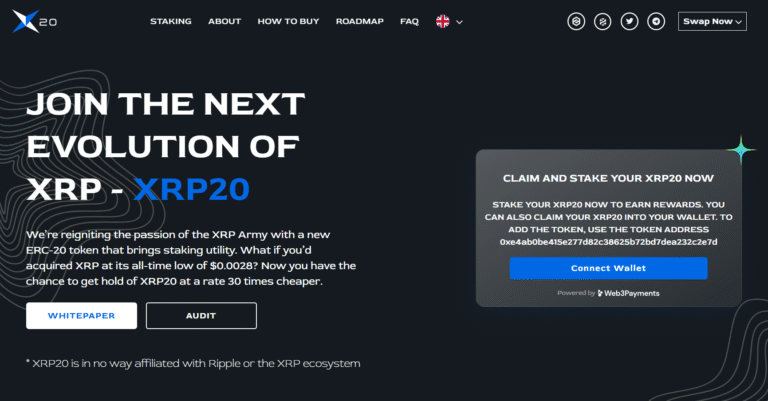

This article provides a detailed XRP20 review to explore its legitimacy and potential risks, including whether XRP20 is a scam. XRP20 is a cryptocurrency claiming to build upon the popularity of Ripple’s XRP network while offering new decentralized features. However, given the lack of transparency and numerous online complaints, investors are questioning: is XRP20 a fraud or a legitimate crypto project? This XRP20 review uncovers all the warning signs you need to consider before investing.

Our target audience includes both individuals who may have already experienced losses with XRP20 and those skeptical about investing in it for the first time. We address concerns, highlight risks, and provide factual information to help users make informed decisions.

XRP20: Regulation & Legal Status

XRP20 operates as a decentralized token and is not regulated by any formal financial authority. It is not registered with regulatory agencies such as the SEC, FCA, or ASIC. The team behind XRP20 remains largely anonymous, which raises questions about accountability and investor protection.

Investing in unregulated tokens presents major risks: no oversight, no client protection, and no mechanisms for dispute resolution. Many projects have used misleading references to top-tier authorities to appear legitimate. For guidance on avoiding similar risks, learn how to spot a scam broker before it’s too late. This lack of oversight raises serious questions about whether XRP20 is a scam.

Trading Conditions & Platform Analysis of XRP20

XRP20 is primarily traded on decentralized exchanges (DEXs) like Uniswap and PancakeSwap. It does not offer account tiers, minimum deposits, or regulated leverage. The token emphasizes deflationary mechanisms and token reflections as incentives, but these features are not formally audited.

Investors should be cautious about exaggerated claims of guaranteed returns or rapid profits. Without transparent liquidity providers or third-party verification, these promises may be misleading. Always check fundamentals with platforms like what to check before signing up with a trading platform. These gaps make it difficult to dismiss the possibility that XRP20 might be a fraud.

Reputation & User Reviews About XRP20

Online reviews of XRP20 are mixed and often difficult to verify. Some investors praise its potential as a derivative of the XRP ecosystem, while others report problems with liquidity, withdrawal issues, and limited transparency. Platforms such as XRP20 reviews on TrustPilot highlight numerous unverifiable testimonials, making it challenging to separate fact from hype.

Engagement metrics indicate sporadic interest, which is common among meme or speculative tokens. Community forums often reveal patterns where early investors may benefit disproportionately, a tactic seen in other high-risk crypto launches.

How to Test Whether XRP20 Is a Scam

To evaluate XRP20’s legitimacy, consider these steps:

- Check Regulation: XRP20 is unregulated, which warrants extreme caution.

- Identify Red Flags: Vague team information, unrealistic profit claims, or false association with established crypto networks.

- Read Genuine Reviews: Look for repeated complaints regarding withdrawals or token lock-ups.

- Test the Platform: Start with minimal transactions; poor design or performance inconsistencies can indicate risk.

- Verify Smart Contract: Use tools like XRP20 contract validator to ensure authenticity and check for vulnerabilities.

These checks help investors make informed decisions and minimize exposure to fraudulent practices surrounding XRP20.

Final Verdict & Alternatives

While XRP20 is not officially classified as a scam, its unregulated status, anonymous development team, and lack of transparency make it a highly risky investment. Investors should approach cautiously.

Safer alternatives include established cryptocurrencies such as XRP, Ethereum, or Binance Coin, which operate under verified security standards and regulatory oversight. Prioritizing licensed platforms reduces risk and ensures greater protection of your funds.