Table of Contents

Introduction to Zeply

This article is a detailed Zeply review tailored for crypto investors who are either victims of suspicious activity or skeptical about the legitimacy of this platform. Zeply positions itself as a cryptocurrency exchange and digital wallet service, allegedly offering seamless transactions, instant Bitcoin conversion, and secure storage solutions. The company claims to be registered in Estonia—a jurisdiction known for its relatively relaxed crypto regulations.

But amidst user complaints and regulatory gray areas, the pressing question remains: is Zeply a scam or a trustworthy crypto solution? Whether you’ve already lost funds or are currently doubting whether to deposit, this Zeply review uncovers all the warning signs you need to know.

Zeply: Regulation & Legal Status

Zeply presents itself as an EU-registered service, but a deeper look reveals that it is registered with Estonian regulators—not licensed by top-tier bodies like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). It’s critical to understand the distinction: registration does not equal regulation. Many crypto entities exploit Estonia’s initial openness to register without meeting the standards set by financial regulators in more heavily policed markets.

Without actual regulatory oversight, platforms like Zeply can operate without proper client protection, secure fund segregation, or legal accountability. And when things go wrong—such as blocked withdrawals or lost crypto—there’s often no direct way to recover funds.

Investors can check Zeply’s safety and licensing status here to better understand what protections are missing. The lack of oversight raises serious questions about whether Zeply is a scam.

Trading Conditions & Platform Analysis of Zeply

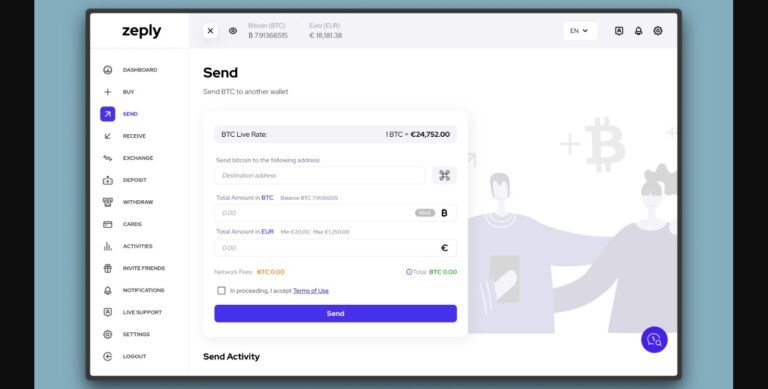

Zeply does not function like a traditional trading platform with multiple coins, leverage, or advanced order types. Instead, it offers simple buy/sell transactions primarily involving Bitcoin. There are no clear account types, no published fee structures, and minimal technical details about how trades are executed or what liquidity providers they use.

Additionally, the platform does not offer transparency on spreads, exchange rate fluctuations, or execution methods. While the user interface may appear smooth, such minimal information creates significant trust issues for experienced crypto users.

Keep in mind that a clean UI or quick conversion feature does not substitute for regulatory transparency. Here’s what to check before signing up with a trading platform like Zeply if you want to avoid hidden risks.

With these oversights, it’s not unreasonable to consider whether Zeply might be a fraud rather than a fully legitimate service.

Reputation & User Reviews About Zeply

While Zeply maintains a relatively clean online image, deeper research shows some disturbing patterns. Several users have posted complaints on forums and third-party sites about withdrawal delays, sudden account verifications after deposits, and unresponsive customer support.

On Trustpilot, Zeply holds a moderately positive rating. However, many of the five-star reviews lack detail or appear templated, a red flag for fake or incentivized feedback. Reviews mentioning real issues—like failed transactions or locked accounts—are often buried beneath generic praise.

Scam reporting platforms like ScamDoc assign Zeply a low trust index, citing missing ownership transparency and weak domain history signals. Such inconsistencies highlight the growing suspicion around the platform and justify asking: is Zeply a scam hiding in plain sight?

How to Test Whether Zeply Is a Scam

If you’re unsure whether Zeply is trustworthy, here’s a practical checklist you can follow:

- Check regulation status – Confirm if the platform is regulated, not just registered. Use official resources like the SEC’s database or local EU licensing records.

- Watch for vague terms – Missing details on fees, ownership, or compliance policies should immediately raise alarms.

- Investigate user reviews – Don’t rely on star ratings. Dig into detailed feedback and patterns on crypto forums.

- Test the platform minimally – Start with a very small deposit to test functionality, especially withdrawal processing.

- Review withdrawal conditions – Lack of transparency on limits, timelines, or conversion rates is suspicious.

- Avoid platforms promising safety without proof – Security claims must be backed by independent audits or licenses.

You can also report your experience or check complaints using the FTC’s fraud report tool.

Final Verdict & Alternatives

While Zeply appears legitimate on the surface, the absence of true regulatory compliance, a lack of trading transparency, and growing user complaints are major concerns. For anyone who has lost money or is unsure about using the platform, the evidence suggests that caution is more than justified.

If you want safer alternatives, consider regulated exchanges such as:

- Coinbase – Licensed in multiple jurisdictions including the U.S. and EU

- Kraken – Well-known for transparency and strong compliance policies

- Gemini – Regulated by the New York State Department of Financial Services

The crypto space is risky enough—don’t increase that risk by using unregulated or opaque platforms. If you’re still asking yourself, is Zeply a fraud?, you may already know the answer.