Table of Contents

Are you worried about whether Damu is legitimate or a potential scam? You’re not alone. This comprehensive review investigates Damu broker to determine if it’s a trustworthy trading platform or something more sinister. Whether you’ve already deposited money with Damu or are considering doing so, this article provides crucial information to protect your investment.

Our target audience includes both those who have already invested with Damu and are experiencing difficulties, as well as potential investors seeking reliable information before committing their funds. If you’re feeling anxious about your deposits or suspicious about Damu’s legitimacy, this Damu broker review will address your concerns and provide actionable guidance.

Introduction to Damu

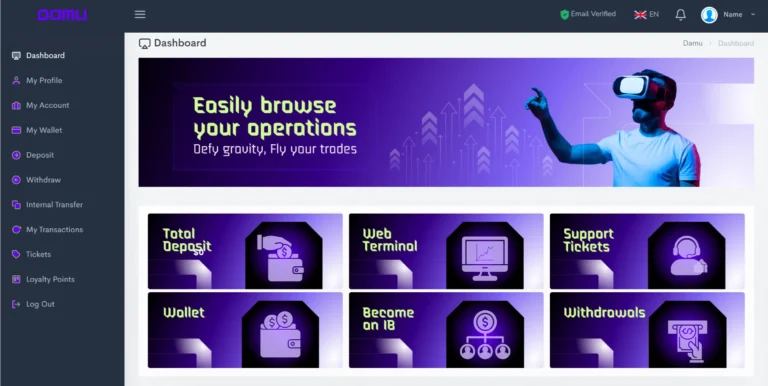

Damu presents itself as a trading platform offering various financial instruments. However, upon closer inspection, serious concerns emerge about this broker’s legitimacy. Many users searching for “is Damu a scam” or “Damu fraud warning” have reported troubling experiences that warrant investigation.

The broker claims to provide trading services from an undisclosed location, but the lack of transparency regarding its operations raises immediate red flags. The absence of clear information about Damu’s corporate structure, physical address, and regulatory standing should immediately put potential investors on high alert.

This Damu review uncovers the warning signs you need to know before risking your hard-earned money with this broker.

Regulation Breakdown

The most alarming discovery about Damu is its complete lack of regulatory oversight. Legitimate brokers are licensed by respected financial authorities such as the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), or Cyprus Securities and Exchange Commission (CySEC).

According to independent broker review aggregator WikiBit, Damu operates without any valid regulatory licenses, putting clients at significant risk. You can verify this information by checking official regulatory registers, such as the FCA Financial Services Register.

Operating without regulation means:

- No oversight of Damu’s financial practices

- No protection for client funds

- No recourse through regulatory bodies if issues arise

- No compliance with industry standards and ethical guidelines

This regulatory vacuum is perhaps the single most important warning sign about Damu’s operations. Fraudulent brokers often hide behind impressive websites and aggressive marketing while deliberately avoiding regulatory scrutiny that would expose their deceptive practices.

User Complaints

A pattern of user complaints has emerged regarding Damu, mirroring the typical issues seen with fraudulent brokers. These include:

Withdrawal Problems

The most common complaint involves withdrawal difficulties. Users report:

- Unexplained delays in processing withdrawal requests

- Outright denial of withdrawals

- Additional verification requirements suddenly appearing when attempting to withdraw

- Claims of “terms violations” or “platform abuse” as pretexts for refusing withdrawals

When customers can’t access their own money, it’s one of the clearest indicators of a potential scam operation.

Unresponsive Customer Support

Many users report that Damu’s customer support:

- Becomes unresponsive when withdrawal requests are made

- Provides generic responses that don’t address specific concerns

- Promises follow-ups that never occur

- Becomes unreachable altogether when serious issues arise

This pattern of behavior suggests a deliberate strategy to frustrate clients attempting to recover their funds.

Account Manipulation

Some users have reported suspicious account activities:

- Unauthorized trades appearing in their accounts

- Account balances mysteriously decreasing

- Unexplained fees or charges

- Account freezes without valid explanation

These complaints align with typical tactics used by fraudulent brokers to separate clients from their deposits.

The Psychology of the Trap: Reviews on How Users Got Scammed

Understanding how Damu and similar operations entrap users can help you avoid becoming their next victim. The psychological tactics employed are sophisticated and highly effective.

The Bonus Trap

Damu reportedly offers attractive “bonuses” to new depositors. What they don’t prominently disclose are the restrictive conditions attached to these seemingly generous offers:

- Excessive trading volume requirements before withdrawals are permitted

- Time limitations that make meeting these requirements virtually impossible

- Clauses that tie up not just the bonus amount but your entire deposit

These bonuses are designed not as rewards but as mechanisms to lock in your funds.

Pressure Tactics and False Promises

Users report being subjected to:

- High-pressure sales calls from “account managers”

- Promises of unrealistic returns (“guaranteed profits”)

- Claims of insider information or proprietary trading algorithms

- Urgent demands for larger deposits to “capitalize on opportunities”

Remember: legitimate brokers never guarantee profits or pressure you into depositing more than you’re comfortable with.

Manipulation of Early Success

A common tactic reported with operations like Damu involves:

- Initially showing profitable trades (possibly manipulated)

- Building trust and excitement through early “successes”

- Using this false confidence to encourage larger deposits

- Once substantial funds are deposited, the account begins showing losses

This calculated approach exploits human psychology, using early wins to overcome natural caution.

Too Many Red Flags to Ignore

Beyond the major concerns already outlined, several additional red flags indicate Damu is likely not a legitimate broker.

Domain and Online Presence Issues

Analysis of Damu’s online footprint reveals concerning patterns:

- Recently registered domain (legitimate brokers typically have established online histories)

- Hidden ownership information through privacy services

- Server locations in jurisdictions known for lax oversight

- Website content copied from legitimate brokers with minimal changes

You can verify these concerns using tools like Scam Detector or Web Paranoid.

Suspicious Review Patterns

The online reputation of Damu shows concerning patterns:

- Clusters of extremely positive reviews appearing simultaneously

- Reviews with similar writing styles and grammatical patterns

- Vague praise without specific details about the service

- Few or no responses to negative reviews

These patterns suggest artificial manipulation of online reputation rather than genuine customer satisfaction.

Lack of Transparency

Legitimate brokers provide clear information about:

- Their corporate structure and leadership team

- Physical office locations and contact information

- Regulatory licenses with verification numbers

- Detailed fee structures and trading conditions

Damu’s lack of transparency on these fundamental aspects is deeply concerning.

| Damu Broker Review Summary | |

|---|---|

| Regulation Status | ⚠️ Unregulated |

| Transparent Ownership | ❌ No |

| Withdrawal Process | ❌ Problematic according to user reports |

| Customer Support | ❌ Unresponsive when issues arise |

| Realistic Promises | ❌ Makes unrealistic profit guarantees |

| Transparent Fee Structure | ❌ Unclear |

| Scam Risk Level | ⚠️ VERY HIGH |

How to Test Whether Damu Is a Scam

If you’re still uncertain about Damu’s legitimacy, there are several practical steps you can take to test the broker before risking significant funds.

Verify Regulatory Status

The most critical test is regulatory verification:

- Visit official regulatory websites like FCA, ASIC, or CySEC

- Search their registers for “Damu” and any company names associated with the broker

- Check if the registration numbers provided by Damu match official records

In Damu’s case, this verification process reveals that the broker lacks regulatory oversight, a serious concern for potential investors.

Test Withdrawal Processes

Before making large deposits, test the withdrawal system:

- Deposit a small amount that you’re willing to lose entirely

- Attempt a withdrawal shortly afterward

- Document the process, including all communications

- Note any obstacles, delays, or additional requirements imposed

Legitimate brokers process withdrawals efficiently and without unnecessary obstacles.

Scrutinize Trading Conditions

Examine the trading environment for manipulation:

- Watch for unusual slippage or price differences from market rates

- Compare quoted prices with those from established financial information sources

- Be alert for technical “glitches” that only occur during profitable trades

- Monitor for unauthorized trades or account changes

Any discrepancies could indicate platform manipulation designed to create losses.

Evaluate Customer Support

Test the responsiveness and knowledge of support staff:

- Ask specific questions about regulatory status and corporate structure

- Request detailed explanations of trading conditions and fees

- Note how quickly and thoroughly they respond

- Assess whether answers are direct or evasive

Vague responses or avoidance of direct questions are significant warning signs.

Final Scam Review Verdict – Is Damu Scam or Not?

Based on our comprehensive investigation, there are overwhelming indications that Damu operates as a fraudulent broker. The complete lack of regulatory oversight, concerning user complaints about withdrawal issues, absence of corporate transparency, and multiple operational red flags all point to a high-risk, potentially fraudulent operation.

Our verdict: Damu displays all the characteristics of a scam broker, and we strongly advise against depositing funds with this entity. The risk of losing your entire investment appears extremely high based on the evidence gathered.

For safer alternatives, we recommend only considering brokers regulated by tier-1 authorities like FCA, ASIC, or CySEC, with established track records and transparent operations. Visit FraudReviews for guidance on identifying legitimate financial service providers.

What to Do If You’ve Been Scammed by Damu

If you’ve already deposited money with Damu and are experiencing issues, take these steps immediately:

Preserve Evidence

Document everything related to your Damu account:

- Take screenshots of your account dashboard, balance, and trading history

- Save all email communications with Damu representatives

- Record details of phone conversations (date, time, representative name, content)

- Preserve deposit and withdrawal attempt records

- Screenshot any promises or guarantees made

This evidence will be crucial for any recovery attempts or complaints to authorities.

Contact Financial Institutions

If you used credit cards or bank transfers to fund your Damu account:

- Contact your bank or card issuer immediately to report potential fraud

- Request a chargeback or transaction reversal if possible

- Consider freezing your cards or accounts if you provided sensitive financial information

- File a formal dispute with detailed documentation of your experience

Act quickly, as there are often time limitations for filing disputes.

Report to Authorities

File complaints with relevant financial and law enforcement authorities:

- Your country’s financial regulatory body

- National fraud reporting centers

- Internet crime complaint centers

- Local police if significant sums were lost

While recovery may be challenging, your reports help authorities build cases against fraudulent operations.

Seek Professional Assistance

Consider consulting with:

- Financial fraud specialists

- Legal professionals experienced in investment fraud

- Reputable fund recovery services (research carefully to avoid recovery scams)

Never pay upfront fees to recovery services that guarantee results – this could be a secondary scam targeting victims.

For additional guidance on protecting yourself from broker scams and understanding the latest tactics used by fraudulent operations, visit our comprehensive scam knowledge center.

Remember: legitimate brokers are transparent about their operations, maintain proper regulatory licenses, and don’t pressure clients or create obstacles to withdrawals. Always conduct thorough due diligence before entrusting your funds to any financial service provider.