Table of Contents

Valetax is a relatively new forex broker, operating globally and claiming to serve over 300,000 clients across 15 regions. While it presents itself as a modern, STP-based CFD broker with fast execution and tight spreads, many investors are asking one critical question: is Valetax truly safe, or is it hiding something?

This in-depth review about Valetax Broker will cover everything you need to know—from regulation and safety to trading conditions and user feedback—so you can decide whether to trust this platform with your money.

1. Who is Valetax?

Valetax markets itself as a forward-thinking forex broker offering access to over 100 tradable instruments, including more than 60 forex pairs, indices, commodities, cryptocurrencies, and possibly equities (though sources conflict on that last point).

The company was established over seven years ago and has gained traction as a global broker headquartered in Mauritius, with an additional registration in Saint Vincent and the Grenadines.

Valetax describes itself as an STP (Straight Through Processing) broker—meaning orders are supposed to be sent directly to liquidity providers without dealing desk interference. The platform claims lightning-fast execution (from 0.1 seconds), competitive spreads, and high leverage. But does it deliver?

2. Regulation & Fund Safety: The Most Critical Factor

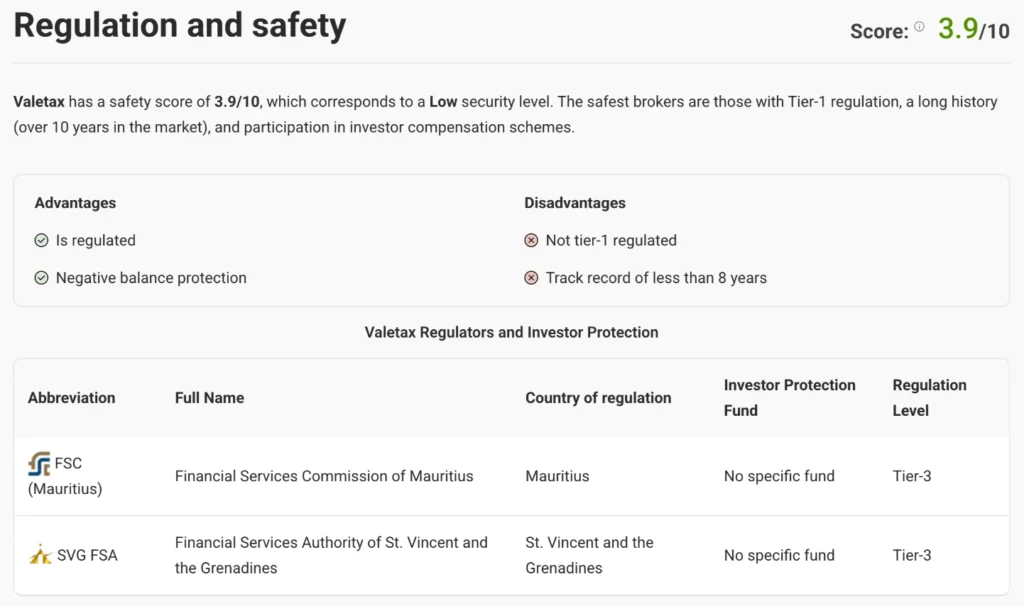

Valetax claims to be regulated by the Financial Services Commission (FSC) of Mauritius, under license number GB21026312. However, verification of this license has raised questions. Some sources suggest the license is not fully confirmed, which casts doubt on the broker’s regulatory standing.

Additionally, Valetax is registered in Saint Vincent and the Grenadines—a jurisdiction known for light or nonexistent regulation of forex firms. It’s important to note that registration is not the same as licensing.

While Valetax offers features such as segregated client accounts and negative balance protection, it still lacks Tier-1 regulatory oversight, which is standard among top brokers like those licensed by the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

According to Traders Union, Valetax has a low safety score of 3.9/10, indicating weak investor protection. Though it promotes KYC compliance and secure payment gateways, the absence of verified regulation remains a red flag.

3. Trading Conditions and Account Types

Valetax provides several types of trading accounts, tailored to both beginners and advanced traders:

- CENT Account – For beginners. Minimum deposit: $1. Leverage up to 1:1000. No commission.

- Standard Account – Minimum deposit: $10. Leverage up to 1:2000. No commission.

- ECN Account – Designed for professionals. Minimum deposit: $50. Spreads from 0.0 pips + $2 commission per lot.

- Booster / Bonus Accounts – Minimum deposit: $1. Offer cashback and trading bonuses.

- PRO Account – High-performance option. Minimum deposit: $500. Spreads from 0.6 pips. Leverage up to 1:2000.

- Swap-Free (Islamic) and Demo accounts are also available.

All accounts offer negative balance protection, and trading conditions such as hedging, scalping, and automated trading are fully supported.

4. Platforms and Assets

Valetax supports MetaTrader 4 and 5, accessible via desktop, mobile, and web. These platforms are industry-standard and known for their reliability, ease of use, and support for EAs (Expert Advisors).

The broker offers a relatively broad range of assets, including:

- 60+ Forex pairs

- Commodities (Gold, Oil, Natural Gas)

- Indices (S&P 500, NASDAQ 100)

- Cryptocurrencies (Bitcoin, Ethereum, Litecoin)

- Equities? – Conflicting reports. Some sources say yes; others say stock trading is not supported.

Despite the variety, the total number of instruments (~100) is still modest compared to industry leaders.

5. Reputation & Client Feedback

Client reviews for Valetax are mixed.

Positive experiences highlight:

- Easy account setup (especially CENT account with $1 minimum)

- Fast withdrawals

- Responsive customer service (according to some)

- Attractive leverage and execution speed

Negative reviews raise concerns:

- Unverified regulatory status makes some traders hesitant to deposit large sums

- Withdrawal issues reported, including delays or lack of response

- Slow or inadequate support during peak hours

- Limited educational resources and transparency in some areas

6. Pros & Cons at a Glance

Pros:

- Extremely low entry barrier ($1 deposit)

- High leverage (up to 1:2000)

- No trading commissions (on most accounts)

- Full MT4/MT5 support

- Negative balance protection

- Segregated client funds

- Fast deposits/withdrawals

- 24/7 live chat (even before opening an account)

- Scalping, hedging, and bots allowed

Cons:

- Unverified regulatory status

- Not regulated by Tier-1 authorities

- Some reports of withdrawal issues and vague support

- Limited educational content

- Not the most competitive spreads in the industry

- Fewer tradable assets compared to larger brokers

- Limited base currencies and payment options

- Website lacks advanced analytics and trader tools

7. Final Verdict: Should You Trust Valetax?

After carefully analyzing all available information, it’s clear that Valetax is a medium-risk broker with both promising features and several points of concern.

It offers fast onboarding, flexible trading accounts, and wide platform compatibility—but traders should proceed with caution, especially due to the lack of confirmed regulatory oversight and mixed user feedback.

This is not necessarily a scam broker, but it fits the profile of a company that might expose your funds to unnecessary risk, especially if you’re not an experienced trader.

Behind the polished interface and promises of “advanced fintech solutions” lies a platform with unverified regulatory claims and unresolved withdrawal concerns.

We strongly recommend that traders looking for long-term stability consider brokers regulated by Tier-1 financial authorities.

⚠️ If You’ve Already Deposited Funds or Are Experiencing Issues

Don’t wait. If you’ve encountered problems withdrawing funds or suspect you’ve been misled:

- Document everything: Save emails, chats, screenshots

- Request a chargeback: Contact your bank or card issuer

- Seek legal advice: You may have recourse depending on your country

- Report the broker: Notify consumer protection and financial watchdogs in your jurisdiction

We understand how stressful this situation can be. If Valetax has misled you or is withholding your funds, contact us immediately. Our team specializes in broker scam investigations and can help you explore your next steps safely and confidentially., indices, commodities, cryptocurrencies, and possibly equities (though sources conflict on that last point).

The company was established over seven years ago and has gained traction as a global broker headquartered in Mauritius, with an additional registration in Saint Vincent and the Grenadines.

Valetax describes itself as an STP (Straight Through Processing) broker—meaning orders are supposed to be sent directly to liquidity providers without dealing desk interference. The platform claims lightning-fast execution (from 0.1 seconds), competitive spreads, and high leverage. But does it deliver?