Payback LTD Review: Company Seized by FBI for Suspected Fraud

Introduction

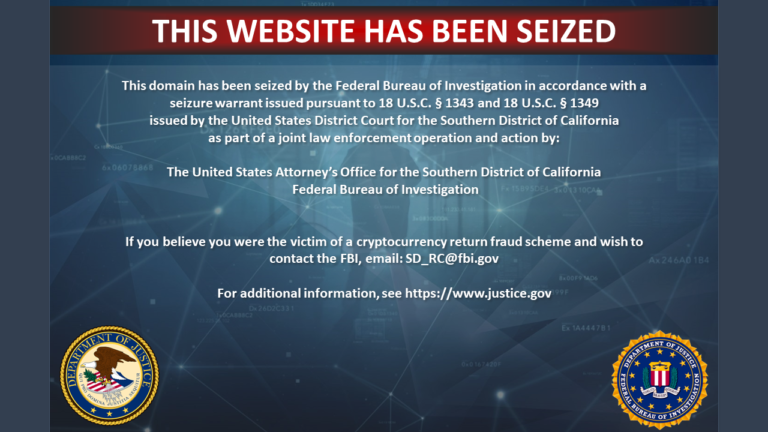

Payback LTD, a well-known company in the asset recovery industry, has been shut down by the FBI due to suspected fraud. This article explores the background of Payback LTD, the events leading to its closure, and the effects on its customers and the industry.

Background

Payback LTD was known for helping people recover lost money from online scams. The company grew quickly due to its claimed success rates and positive reviews. Many trusted Payback LTD with their recovery needs, believing it to be a reliable service.

Events Leading to the FBI Seizure

Problems started when customers began complaining about Payback LTD’s services. These complaints led to an investigation by the FBI. Key events include:

- Numerous customer complaints and bad reviews.

- Internal investigations showing irregularities.

- FBI raids on Payback LTD’s offices.

- Evidence of fraudulent activities found by the FBI.

The FBI Investigation

The FBI’s investigation into Payback LTD uncovered serious fraud. They found fake recovery reports, false claims of success, and manipulated customer data. FBI officials emphasized the seriousness of these fraudulent activities.

Impact on Customers

The shutdown of Payback LTD has left many customers confused and worried about their money. The financial and emotional impact on these individuals is significant. Affected customers should:

- Contact the FBI for updates on their cases.

- Seek legal advice to understand their rights.

- Stay alert to avoid further scams.

Industry Reactions

The news about Payback LTD’s fraud shocked the recovery industry. Other companies and industry experts are calling for stricter regulations and more transparency. This situation might make potential clients more cautious, affecting the industry negatively in the short term.

Legal Consequences and Future Outlook

The company and its executives could face severe legal consequences, including charges of fraud and money laundering. The company’s future is uncertain, with its assets likely being sold to compensate customers. This case is a warning to other businesses in the industry to maintain ethical practices.

Conclusion

The FBI’s seizure of Payback LTD highlights the need for vigilance among consumers and stricter oversight of recovery companies. As legal proceedings continue, it is important for affected customers to stay informed and seek the support they need.

FAQs

What led to the FBI’s seizure of Payback LTD? Customer complaints and an FBI investigation revealing fraud led to the seizure.

How can customers recover their funds? Customers should contact the FBI and seek legal advice for recovery options.

What are the signs of a fraudulent recovery company? Signs include unrealistic promises, lack of transparency, bad reviews, and pressure to pay quickly.

How will this affect the recovery industry? The industry might face more scrutiny, stricter regulations, and a temporary loss of consumer trust.

What are the next steps for affected clients? Clients should stay in touch with the authorities, seek legal advice, and be cautious of further scams.

Would you like a list of keywords for your digital marketing, content strategy, PPC campaigns, social media engagement, or email marketing campaigns? Additionally, I can provide related topics for more content creation.

How to Get Your Money Back from a Scam

If you’ve fallen victim to an online scam, it might seem hopeless. Many people are unaware of legitimate companies that can help recover their funds and often end up getting scammed again by fraudulent services. Our article, “How to Get My Money Back from a Scam,” compiles a list of top-rated recovery companies and is continuously updated to ensure accuracy. For professional assistance and to increase your chances of recovery, check out our detailed guide on “how to get my money back from scam”.